Organisational change is the process by which organisations transform from their present state to a desired future state to obtain or increase their strategic advantage in the constantly evolving business or economic environment.

Through innovation, organisations are able to put to effective use of creative ideas into products, services and business processes that serve to satisfy customers or help organisations better produce them.

Thus, it is important for organisations to be able to manage change and innovations to ensure business continuity, sustain competitiveness and profitable growth.

1.0 Forces of Change

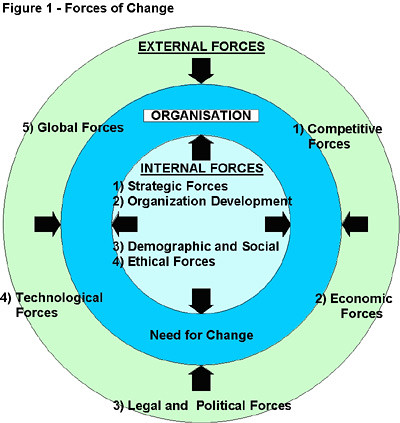

Let us consider the major factors in the business environment that create pressures on organisations, thus forcing change.

The business environment consists of the economic, legal and political, social, technological, and management factors that affect business activities. Significant changes in any part of the business environment are likely to create pressures on organisations.

The forces of change can be categorized as external and internal forces of change. Figure 1 summarizes the major forces of change which organisations face.

Competitive Forces

Successful organisations continuously strive to obtain a competitive advantage over other organisations. Since organisations need to match or exceed competitors in at least one of the dimensions of competitive advantage such as in efficiency, quality, innovation or customer care, competition becomes a force of change.

To lead in efficiency and quality, organisations need to adopt the latest technologies and processes such as computer-in-manufacturing and ERP systems. In adopting new technologies and processes, employee work relationships also changes, as the employees need to learn new skills and techniques or acquire new knowledge. To lead in innovation and thus obtain a technological edge over competitors, organisations need to possess skills in managing the process of innovation.

Therefore, the ability to manage change is central to the ability to obtain and sustain a competitive advantage in a marketplace that different organisations compete for the same customers.

Economic, Legal and Political, and Global Forces

Economic, legal and political, and global forces continuously affect organisations and force them to change how and where they trade, produce goods and services.

In North America, the North American Free Trade Agreement (NAFTA) has established trade cooperation between the United States, Canada and Mexico, leading to many organisations in these countries taking advantage to find new markets for their products and services, and new sources of inexpensive resources such as labour and raw materials.

In Europe, the European Union (EU) has grown to include more than 20 countries, and countless organisations seek to exploit the advantages of a large and protected market for their products and services, and resources.

In Asia, Japan and other fast-growing Asian countries such as China, Taiwan, Malaysia and Thailand, recognizing how these economic unions protect their members and create barriers against foreign competition, have also moved to form the Asean Free Trade Agreement (AFTA) and other trade cooperation initiatives such as the East Asia Summit (EAS).

Organisations that fail to exploit low-cost resources and the rise of low-cost foreign competitors and development of new technologies that can erode an organisation’s competitive advantage can bring doom to any organisation that does not change and adapt to the realities of the international or regional marketplace. Other challenges facing organisations are the need to change the organisational structure to allow expansion into foreign markets and the need to change in order to adapt to different cultures.

Demographics and Social, Organisational Development, and Ethical Forces

Workforce composition changes and increasing diversity of employees presents organisations with many challenges and opportunities. Increasing changes in the demographic characteristics of the workforce leads to managers changing management styles and methods.

While the forces of change appear to bombard organisations from all sides, progressive and successful organisations do not fear change. As a matter of fact, such organisations effect changes to their organisations. Changes initiated by organisations are known as planned change. The practice of organisational development (OD) –

[Cummings & Worley, 2005, pg. 1], is to bring about planned change to increase an organisation’s effectiveness and capability to change itself."A process that applies behaviourial science knowledge and practices to help organisations build the capacity to change and to achieve greater effectiveness, including increased financial performance and improved quality of work life."

Many leading international companies such as General Electric, Hewlett Packard, Motorola and Boeing, practices organisation development to continuously improve organisational effectiveness and competitiveness.

It is also important for organisations to take steps to promote ethical behaviour in the face of increasing governmental, political and social demands for more responsible and honest corporate behaviour and governance.

Strategic and Technological Forces

One of the key challenges facing all organisations is sustaining profitable growth. Organisations that are able to year after year create and sustain superior performance against the competition have what is known as competitive advantage.

Competitive advantage can be defined as “anything that a firm does especially well compared to rival firms.” [David, 2005, pg. 8] In other words, when a firm can do something that rival firms cannot or owns something that rival firms desire to acquire or achieve, that can represent a competitive advantage.

In Michael Porter’s seminal work Competitive Advantage: Creating and Sustaining Superior Performance, he said,

[Porter, 1985, pg. xv]“Competitive advantage is at the heart of a firm’s performance in competitive markets. After several decades of vigorous expansion and prosperity, however, many firms lost sight of competitive advantage in their scramble for growth and pursuit of diversification. Today the importance of competitive advantage could hardly be greater. Firms throughout the world face slower growth as well as domestic and global competitors that are no longer acting as if the expanding pie were big enough for all.”

Although published in 1985, his work and words still ring true in the 21st century!

Strategic management is all about gaining and maintaining competitive advantage. Organisations today consider and practices strategic management more importantly and seriously than ever before. Thus, organisational change is also brought about by the implementation of new strategies.

The Internet boom and new developments in technologies have also brought about the need for organisations to change. For organisations able to understand and harness the benefits of new technologies such as electronic commerce technology, competitive advantage can be developed in the areas of supply chain management, business-to-business (B2B) and business-to-customer (B2C) relationships, for e.g. Dell, Inc.

This is why of late the Malaysian government is seriously encouraging the small and medium enterprises (SMEs) to adopt new technologies in the face of increased globalization and competition. The formation of the SME Bank serves to assist SMEs to acquire loans to upgrade technology and expand their business.

2.0 Targets and Types of Change

2.1 Targets of Change

In addressing change, organisations need to plan for change instead of being adversely affected by unplanned change. Planned change is normally targeted at improving performance in the following 4 major levels:

- Human resources

- Functional resources

- Technological capabilities

- Organisational abilities

Human resources (HR) are an organisation’s most important asset because an organisation’s distinctive competences lie in the skills and abilities of its employees, which contributes to a form of competitive advantage.

Therefore, organisations must continually monitor their organisational structures to establish the most effective way of motivating and organizing HR to acquire and use their skills.

As mentioned earlier, this will form an aspect of organisation development (OD). Hence, typical types of change efforts directed at HR include:

- New investments in training and development activities

- Socialising employees into the organisational culture

- Changing organisational norms and values to motivate multicultural and diverse workforce

- Ongoing review and analysis of promotion and reward systems

- Changing the composition of the top-management team to improve organisational learning and decision making

In organisations, each organisational function needs to develop procedures that allow it to manage the particular business environment it faces. As changes occur, organisations often transfer resources to the functions where the most value can be created.

Organisations can improve the value that its functions create by changing its structure, culture and technology, for e.g. the change from a functional to a product team structure may speed the new product development process.

Technological Capabilities

Technological capabilities give organisations enormous capacity to change itself in order to exploit market opportunities. For e.g.,

- The ability to develop a constant stream of new products or to improve existing products so that they continue to attract customers represent an organisation’s core competences

- The ability to improve the way goods and services are produced in order to increase their quality and reliability is a crucial organisational capability

Through the design of organisational structures and culture, organisations can harness its human and functional resources to exploit technological opportunities. Organisational change often involves changing the relationships between people and functions to increase the ability to create value in order to sustain profitable growth.

2.2 Types of Change

Planned change can be generally categorized into:

- Evolutionary change (Calm waters metaphor) – which is gradual, incremental and specifically focused

- Revolutionary change (White water rapids metaphor) – which is sudden, drastic and organisation-wide

Revolutionary change involves a whole new way of doing things, new objectives, and new structures. Examples of revolutionary changes are Business Process Reengineering (BPR), restructuring and innovation.

3.0 Innovation and Technology

Innovation relates to the development of new products or services, new production or manufacturing processes, and new operational systems.

Technology relates to the skills, knowledge, experience, body of scientific knowledge, tools, machines and equipment used in the communication, design, production and distribution of goods and services.

Technology is central to the operations, goods and services of most organisations. Therefore, technological innovations can have major implications for organisations.

The 8 different types of technological innovations are:

- Product innovation – innovations resulting in products or services

- Process innovation – innovations in business related processes

- Radical innovation – innovations that revolutionizes products, services or processes

- Incremental innovation – innovations that enhances existing products, services or processes

- Competence enhancing innovation – innovations that build on existing knowledge and skills

- Competence destroying innovation – innovations that render existing knowledge and skills obsolete

- Architectural innovation – innovations that affect the entire system or the interactions of a system’s components

- Component innovation – innovations that only affect one or more but not all of the components of the entire system

4.0 Summary

Now that we have an appreciation of what organisational change and innovations are, we can also readily appreciate that organisations need to be in control to respond to or to influence change and innovation. Change cannot be stopped.

Organisations that are unable to deal with change and cannot innovate cannot hope to succeed in the increasingly competitive business environment that is constantly bombarded with forces of change.

Organisations able to manage planned change and innovation to achieve strategic or competitive advantage in the industry they operate in will have a higher chance of business success leading to profitable growth.

Some examples of companies that have been able to successfully manage change and innovation are:

- Dell – computer systems – able to manage the change from telesales to an online system using Internet technology, and innovated on its supply chain processes.

- Apple – computer systems, digital music players – able to manage change and innovation to continuously introduce highly innovative products and services.

- eBay – online auction – able to manage change and innovation to offer customers innovative online auction services.

- Google – online search engine – able to manage change and innovation to understand web-surfers or consumers’ information search needs better than others.

- AirAsia – low cost carrier – able to manage change and innovation to achieve profitable growth in the local Malaysia and regional airline industry in the face of high competition and rising fuel costs.

- Maybank – commercial bank – able to manage change and innovation by foreseeing and offering superior Internet banking facilities to meet consumer needs.

References:

Cummings, Thomas G. & Worley, Christopher G. (2005). Organisation Development and Change. (8th Edition). Mason, Ohio: Thomson South-Western

David, Fred R. (2005). Strategic Management: Concepts and Cases. (10th Edition). Upper Saddle River, New Jersey: Pearson Prentice-Hall

Porter, Michael E. (1980). Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York, NY: The Free Press

Porter, Michael E. (1985). Competitive Advantage: Creating and Sustaining Superior Performance. New York, NY: The Free Press

Schilling, Melissa A. (2005). Strategic Management of Technological Innovation. New York, NY: McGraw-Hill

Tidd, Joe; Bessant, John & Pavitt, Keith. (2005). Managing Innovation: Integrating Technological, Market and Organisational Change. (2nd Edition). New York, NY: John Wiley & Sons