Thus, it has become increasingly necessary to ensure that companies and corporations are effectively and efficiently managed for shareholder value. One approach is known as value-based management.

The Chartered Institute of Management Accountants’ official terminology defines value-based management as “a managerial process which effectively links strategy, measurement and operational processes to the end of creating shareholder value” (Starovic, Cooper & Davies, 2004, p. 2).

Value-based management attempts to identify the basics of value creation by focusing on issues that matters to shareholders, resulting in an acceptable annual return on their capital investments.

Among the key activities and resources being focused around value creation is marketing, and the ability to identify the contribution of marketing and evaluate or measure its effectiveness is necessary in value-based management.

An approach to creating the ability is via value-based marketing. Value-based marketing defines the central objective of marketing as contributing to the maximization of shareholder value by aligning customer focus marketing to the interests of shareholders (Doyle, 2000a, p. 4).

Many companies realize that the key to sustainability and profitability lies with customers. Thus, we see an increasing shift of companies to become more customer-focused in order to increase customer value, and managing customer loyalty to create higher shareholder value (Best, 2009, p. 36).

What is Shareholder Value?

What is shareholder value? How do we measure it? Shareholder value is a financial concept under the ownership of the financial management discipline. Shareholder value is determined by four factors:

- The level of cash flows

- The time value of money or cash

- The durability of cash generating assets i.e. the concept of net present value

- The risks of future cash flows i.e. the opportunity cost of capital (Doyle, 2000b, p. 300)

In non-financial terms, shareholder value can be created when corporate actions result in the:

- Introduction and sales of new products or services, or variations of existing products or services, clearly differentiated from competitors’ offerings

- Adoption of new technologies that will create or enhance its core competencies

- Developing and implementing entry barriers against potential rivals

- Reduction of operating costs or the increase in efficiency of resource utilization (Subbrayan, 2008, pp. 13 – 14)

Consistent successes in creating shareholder value are typically reflected in a company’s share price. In Value-Based Marketing, Doyle says, “The basic principle of shareholder value is that a company’s share price is determined by the sum of all its anticipated future cash flows, adjusted by an interest rate known as the cost of capital” (2000a, p. 33).

Thus, companies that adopt the shareholder value approach will need to maximize returns for shareholders by developing and executing marketing strategies that maximize the value of cash flows over time.

Quantifying Shareholder Value: Basic valuation methods

a) Shares and Shareholder Returns

Shareholder return is derived from the capital appreciation on the value of the stock, and the dividend distribution by the company.

Let us consider a simple example at the personal shareholder level – assuming that the stock of Malaysian Airline System Bhd (MAS) is trading at Malaysia Ringgit 10 per share, and you decide to buy 1,000 shares. Your investment amounts to RM10,000. Five months later, the share is trading at RM10.95 per share, and the company declares a RM2 per share dividend.

What is the current market value of your shares?

Current market value = RM10.95 x 1,000 = RM10,950

How much is the capital gain?

Capital gain = (RM10.95 – RM10) x 1,000 = RM950

How much did you benefit from the RM2 per share dividend?

Dividend income = RM2 x 1,000 = RM2,000

Thus, the total shareholder return = RM950 + RM2,000 = RM2,950. In other words, the original RM10,000 investment has grown into RM12,950 through capital gain and dividend income.

What is the total percentage of shareholder return?

Total percentage return = RM2,950 / RM10,000 = 29.5%

How much of 29.5% is due to capital gain and how much is due to dividend income?

Capital gains yield = (10.95 – 10) / 10 = 9.5% i.e. each Ringgit invested has returned 9.5 sen in capital gains.

Dividend yield = (RM2 / RM10) x 100% = 20% i.e. each Ringgit invested has produced 20 sen in dividends.

In total, each Ringgit invested in MAS’ stock has returned 29.5 sen.

b) Discounted Cash Flow (DCF) and Net Present Value (NPV)

Using a simple example, let us assume that investment analysts have projected that MAS is to produce annual cash flows of RM100,000 for the next five years due to its business transformation plan of implementing a value-based marketing strategy. Will it be worthwhile to invest in MAS now?

We will need to compute the Net Present Value (NPV) of the projected cash flows over the five year period. For this purpose, let us assume the required rate of return is 10 percent.

Referring to a Present Value Table http://www.studyfinance.com/common/table3.pdf for the Present Value Factor, we can create the following Table 1.

Table 1

Since the sum of all present values of cash flows is RM379,070, thus, an investment amount today that is lesser than RM379,070 would constitute a prudent investment.

c) Economic Value Added (EVA)

A measure of shareholder value that has gained popularity is the Economic Value Added (EVA) model, established by Joel M. Stern and G. Bennett Steward III.

The proponents of EVA claim that it is a measure of a company’s true economic value creation, but presently, there is wider acceptance of cash flow as indicator of shareholder value and wealth creation. The fundamental percept of EVA is that true shareholder value is only created if a surplus is created over the total capital invested in the business.

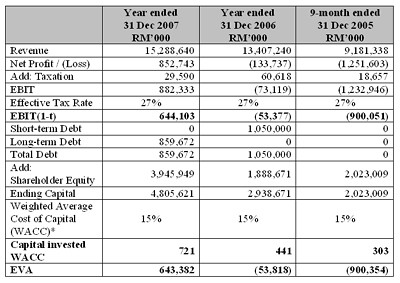

Using data from the 2006 and 2007 Annual Reports of MAS, the EVA is computed as follows:

EVA = EBIT(1-t) – (Capital x WACC)

Table 2: Economic Value Added (EVA) of MAS

* To simply the discussion, we assume that WACC = 15%

Since MAS was loss making in the financial years 2005 and 2006, the EVA reflects that negative shareholder value was created (i.e. the destruction of shareholder value) during those financial years. For the financial year 2007, MAS was profit making again, and positive shareholder value was generated.

We have identified that shareholder return is derived from capital appreciation on the value of the stock, and dividend distribution by the company. The capital appreciation of the value of the stock i.e. creation of shareholder value is determined by the sum of all its anticipated future cash flows, adjusted by an interest rate known as the cost of capital.

Figure 1: Relationship between Marketing and Shareholder Value

Then, how is future cash flows generated? Obviously, the primary source is from sales revenues (Figure 1). Activities such as operational costs reduction and the efficient use of cost resources are indirect means of enhancing cash flows. The higher the sales revenues, the higher the potential for the company to generate more cash flows. In turn, higher sales revenues can be achieved through the successful execution of strategic marketing plans and marketing activities that create higher customer values. Thus, marketing is related to and central to the creation of shareholder value.

References:

Best, Roger J. (2009). Market-Based Management: Strategies for Growing Customer Value and Profitability (5th Edition). Upper Saddle River, New Jersey: Pearson Education Inc.

Creating the Lexus Customer Experience. (2009). The Executive Issue, No: 34, January. Management Centre Europe. Downloaded from http://www.mce-ama.com/downloads/cases/MCE_cat09_CCS-Lexus.pdf

Doyle, Peter. (2000). Value-Based Marketing: Marketing Strategies for Corporate Growth and Shareholder Value. Chichester, England: John Wiley & Sons Ltd

Doyle, Peter. (2000). “Value-Based Marketing.” Journal of Strategic Marketing, Vol. 8 (4), pp. 299 – 311

Hodge, Richard & Schachter, Lou. (2006). “Accelerate Your Customers' Success: The Lexus Sales Story.” CustomerThink.com, September 5. Downloaded from http://www.customerthink.com/article/accelerate_your_customers_success_the_lexus_sales_st

Lexus Earns Best-Selling Luxury Brand Title for Sixth Consecutive Year – Surpasses 300,000 Sales in Record-Breaking Year. (2006). Lexus.com, January 4. Downloaded from http://www.lexus.com/about/news/articles/2006/1/20060104_1.html

Malaysian Airline System Bhd (MAS) 2006 and 2007 Annual Reports. Downloaded from http://www.malaysiaairlines.com/hq/en/corp/corp/relations/info/reports/annual-reports.aspx

Starovic, Danka; Cooper, Stuart & Davis, Matt. (2004). “Maximising Shareholder Value: Achieving clarity in decision-making.” The Chartered Institute of Management Accountants. Downloaded from http://www2.cimaglobal.com/cps/rde/xbcr/SID-0A82C289-AA3CDFE4/live/tech_techrep_maximising_shareholder_value_0105.pdf

Subbrayan, Radhakrishnan. (2008). How a Company Creates Shareholder Value. Petaling Jaya, Malaysia: Leeds Publications

The Chartered Institute of Management Accountants. (2005). “CIMA Business Talk: Creating Shareholder Value.” New Straits Times - Appointments, July 2, p. 12

Wilson, Richard M. S. & Gilligan, Colin. (2005). Strategic Marketing Management: Planning, Implementation and Control (3rd Edition). Oxford, England: Butterworth-Heinemann / Elsevier

No comments:

Post a Comment